What’s driving the sale of financial planning practices?

As a financial services practice broker, it’s important to gain a detailed understanding of vendor motivation to track trends. I recently sat down with my team to look over three years’ worth of data, which captured the motivations of sellers looking to sell their business either partially or fully. The data included those who completed sales and those who were considering selling. Some findings are a given, but some may come as a surprise.

Here’s a look at the data that tells the story of why financial services practices sell.

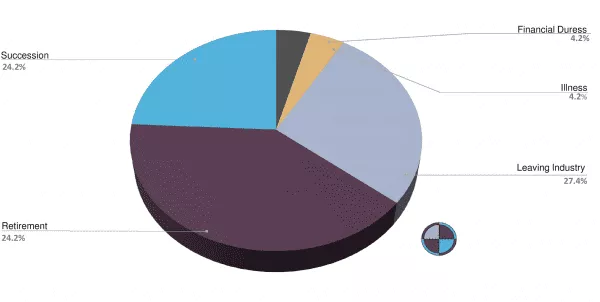

Reasons for sale

Retirement is still the number one motivator for sales, followed by leaving the industry, however this wasn’t the case five years ago. Succession (including a slow phase out) would have been the second most common reason for sale during this time, but now it places third. Other triggers are illness (including the sale of a deceased estate), financial duress (including individual bankruptcy and business in receivership), and leaving the industry.

Reasons for sale by practice size

With retirement as the biggest motivator to sell in general, it’s actually consistent across small (turnover less than $500k), medium (turnover $500k-1.5m), and large (turnover $1.5m-4m) businesses. However, we found that leaving the industry has become an increasingly prevalent reason over the last 15 months due to a requirement of meeting new education standards, including completing an exam imposed by the Financial Adviser Standards and Ethics Authority (FASEA).

As a professional with decades of experience in your industry, would you be willing to study the basics as a formal requirement? Unfortunately, the answer is ‘no’ for owners of established small and medium businesses. They would rather exit and leave the industry than requalify. Meanwhile, medium businesses have communicated to us that larger businesses are better equipped to adapt to these industry changes.

Additionally, there is very little succession in smaller practices. While succession is a common reason for sales in larger businesses, it’s simply not part of the small business mindset. Smaller businesses also seem to sell due to high financial duress.

FASEA influence on leaving by size

It’s clear that FASEA has had a bigger impact on smaller businesses. Some senior Managing Directors have indicated to us that although they themselves are not going through the education programme, they are in a position due to the size of their business to effectively manage the business without providing direct advice themselves. It’s logical for small practices to leave the industry, as they are not as equipped to handle industry changes, from education standards and licencing fees to compliance requirements and insurances.

Small businesses need to have enough top line revenue to justify the existing cost structure. For most, scale is the only answer, however many are exiting instead of buying. On the other hand, larger businesses realise the importance of acquisition and scale at this time, so they are keen to absorb these smaller practices.

FASEA effect on reason for leaving

Has FASEA triggered earlier retirement? This graph suggests so. It shows that FASEA has been a catalyst for retirement earlier than advisers had anticipated. The graph also depicts FASEA’s moderate effect on succession. However, more so than any other reason, it has prompted slightly more advisers to leave the industry for another career.

Reasons for sale by business structure

Do the reasons for sale vary whether the business is a partnership or owned by a single entity? Yes, immensely! Illness is a key trigger for sole owners because there is no one able to take up the reins, resulting in more pressure to act decisively about a sale. The same thing applies when the single owner is under financial duress. The data also shows that succession is more prevalent in partnerships over single owners; and large businesses over small operators.

Retirement among the single owners showed significantly higher as a percentage compared to the larger practices in partnerships. This is because in partnerships, both partners must be retiring simultaneously for retirement to be the cause of a sale.

When it comes to exiting, we speak to partners, business owners, boards, stakeholders and sole practitioners on a daily basis about their options. Many are unaware and often surprised at the number of options available because they only plan when they are forced to, resulting in potential errors. Selling with too little forethought can pose a number of dangers, which is why it’s best to engage with a broker as early in the process as possible to increase optimum outcome.